The Financial Case For Optimizing The Consumer Experience

Health and human service organizations increasingly compete on the quality of consumer experience. In an era of value-based reimbursement, integrated care networks, and tightening payer scrutiny, consumer choice and consumer engagement can no longer be considered strictly a qualitative measure. Whether people choose an organization and whether they remain there throughout their treatment has very real metrics that can help or hinder clinical outcomes and financial performance. And chief financial officers (CFOs) are increasingly involved in decisions about setting and managing those metrics from a strategic perspective, beyond just running the numbers and managing the budgets.

Improving consumer experience requires more than just saying that your digital front door is open. It requires strategic investment in integrated engagement tools and electronic health record (EHR) platforms that offer consumers control over their care, enhance two-way communication, and deliver personalized support across every stage of the care journey. And it requires chief financial officers who have the knowledge to guide, track, and manage that investment as part of a collaborative executive team.

Why? Because consumer experience and consumer engagement drive the results that matter most to payers and consumers alike: adherence, retention, repeat utilization, and outcomes. For self-pay and commercially insured consumers—the consumers with choice—experience ultimately determines whether they walk through the doors or not, and if they do so, whether they remain to complete treatment.

Leadership sets the course of the organization, and the strategic components of that effort are more and more part of the CFO’s portfolio. Managing the assets of the organization isn’t just managing cost—it’s making investment decisions against priorities and opportunities. And consumer experience is an enormous opportunity.

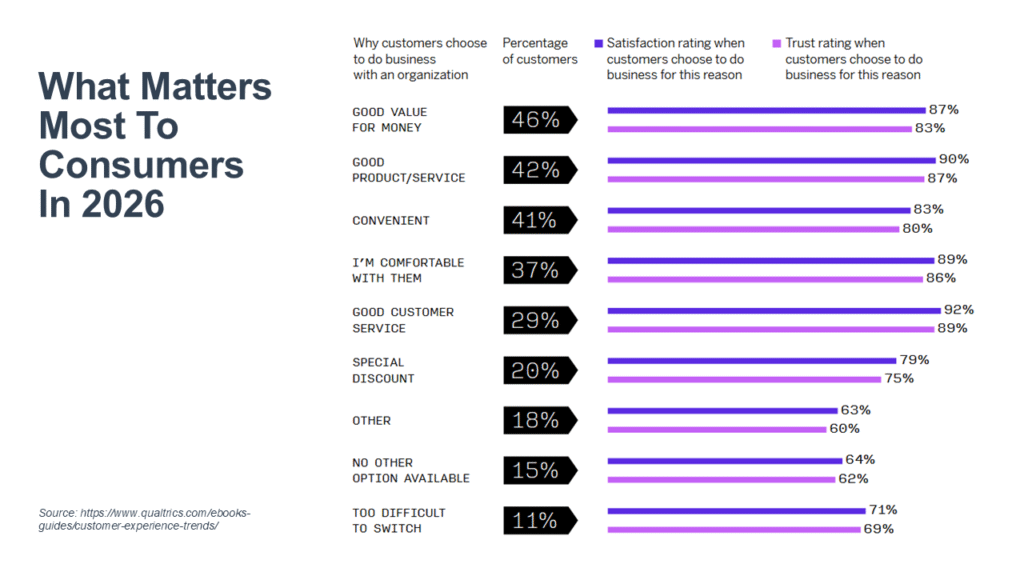

For executives who think that consumer experience is not that important, consider a recent report that finds 30% of consumers don’t report their bad experience, and for every 10 bad experiences, 5 led consumers to reduce—or eliminate—their spending at that organization (see 2026 Consumer Experience Trends Report).

On the flip side, it’s also important to consider the positives. That same report found that satisfied consumers—i.e., those who have a good experience—are four times more likely to recommend an organization, four times more likely to trust it, and two and a half times more likely to use that business again.

CFOs, who are accustomed to measuring performance through numbers, should consider those findings and quickly run the math to see how much of their revenue might be gained, sustained, or lost, based on consumer experience. They should also begin to consider what technology investments can shift their performance from “a bad consumer experience” to the more lucrative “good consumer experience.”

The focus of this CFO newsletter addresses just that. In our first article Consumer Experience Transformation As A Catalyst To Long-Term Financial Sustainability, we look at why CFOs should lead consumer experience initiatives—with strategic participation that goes beyond spreadsheets—where they should focus their attention, and the metrics to guide the process.

In our second article, Chief Financial Officers: Strategic Guides For Consumer Experience Technology Investments, we dive more thoroughly into the CFO’s role in aligning consumer experience and technology investments for the performance that earns a return on investment (ROI) and participating in the technology selection process.

We also present a case study this month, Rebuilding The Consumer Journey: A Case Study, that reveals how one organization created a performance loop that connected customer service, consumer experience, and consumer engagement for an improved consumer journey, with CFO participation in the process.

We have From Check-Ins to Change: Boosting Behavioral Health Outcomes with Personalized Care Journeys from ContinuumCloud, which explores supporting the consumer journey with three key elements of personalized care—customized content and resources, provider matching and coordination, and measurement-based care. The 2025 OPEN MINDS CFO Consortium, sponsored by ContinuumCloud, is an opportunity to take that conversation further—connecting with finance leaders across the sector to share insights, surface pain points, and explore technology solutions that align with mission and margin.

Finally, mark your calendars on February 12, 2026 at The 2026 OPEN MINDS Performance Management Institute in Clearwater Beach, Florida, for the CFO Consortium session, “The Great Divide: Bridging The Gap Between Clinical & Financial Executives.” This session explores practical strategies for bridging the communication and collaboration gap between clinical and financial executives.