Building A Foundation For Resiliency & Financial Sustainability: A Case Study

In today’s health care landscape, achieving financial sustainability demands chief financial officers (CFOs) who can perform strategic functions beyond budgets to navigate a complex confluence of reimbursement volatility, workforce shortages, digital transformation, and value-based care mandates. For many CFOs, this will mean reengineering operations, technology, and organizational culture to build the right foundation for long-term sustainability and resilience. Those skills stretch far beyond the traditional role, and adapting to those demands will define CFO success today and going forward.

For a look at the evolution of the CFO role in action, consider the work done at Volunteers Of America Minnesota & Wisconsin (VOAMNWI), a $32 million provider organization. VOAMNWI serves 23,400 consumers annually through 70 programs for children, youth, families, older adults, people with disabilities, and community reentry for justice-involved individuals, delivered across 110 communities.

The Challenge

In 2022, VOAMNWI was burdened with outdated technology, inefficient manual processes, an unfinished electronic health record (EHR) implementation, and a month-end close cycle that took longer than was ideal, making it challenging to track financial data in real time to guide strategic decision-making. Its broad service mix—from mental health care to housing—created layers of financial and reporting complexity without corresponding systems support, while the market push toward value-based care and integrated services created strategic pressure for VOAMNWI to transform itself. Further complicating the picture, VOAMNWI’s finance department had high turnover, leading to 60% of the staff positions being open, which resulted in a high reliance on costly agency staffing solutions. Onboarding new staff and temporary staff, no matter how capable, was time-consuming, expensive, and a distraction from the needed focus on scenario planning and growth strategies.

Strategic Actions

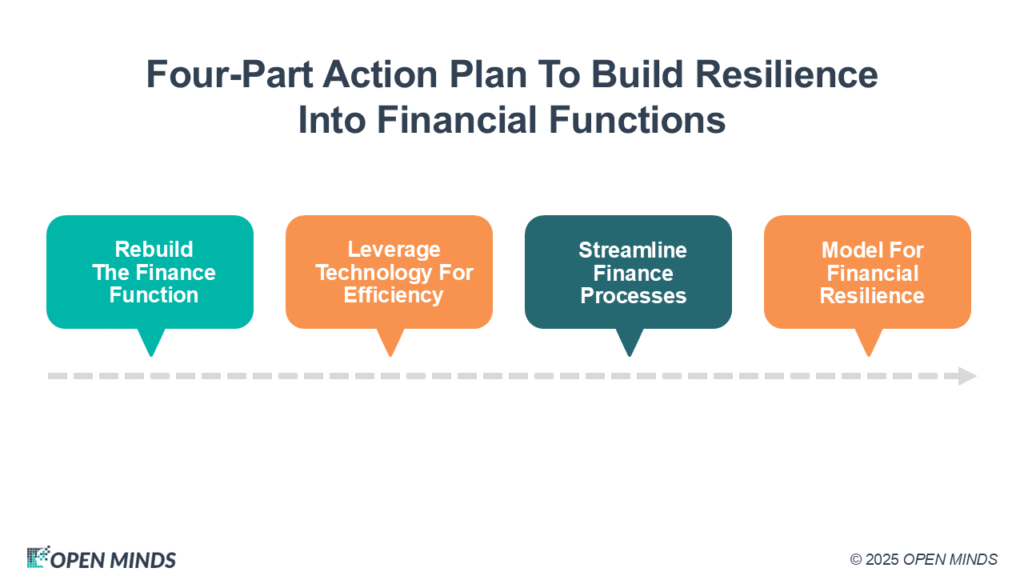

To address these issues, VOAMNWI CFO Deb Steinke launched a four-part action plan to build resilience into financial functions and align operations to advance the organization’s strategic goals. These strategic interventions included:

1. Rebuild The Finance Function: Ms. Steinke’s first action was to fundamentally restructure the workforce by hiring for key team roles. She prioritized the onboarding of a new director of financial planning and analysis and a forward-looking revenue cycle leader. She also prioritized hybrid work models so that VOAMNWI had access to a wider talent pool than only applicants who lived within commuting distance of the office. Widening the geographic range for applicants was a significant factor in achieving the goal of building long-term, stable staff with permanent colleagues and eliminating the need for interim staff.

2. Leverage Technology For Efficiency: Ms. Steinke sought cost-effective efficiencies by overhauling VOAMNWI’s tech infrastructure by first prioritizing the implementation of a new EHR, terminating the use of the legacy EHR, implementing a cloud-based Enterprise Resource Planning (ERP) system, and maximizing the use of Office 365 and Power BI. New technology was selected using a weighted scorecard developed with leadership across different departments, including finance, human resources (HR), information technology (IT), and specific service programs.

3. Streamline Finance Processes: Ms. Steinke eliminated outdated, paper-heavy processes, including a manually tracked credit card program and physical accounts payable (AP) files. Budget prep and month-end close were aligned with continuous improvement principles.

4. Model For Financial Resilience: VOAMNWI simultaneously adopted scenario planning and financial modeling to inform sustainability strategies. The use of these strategic frameworks was crucial in supporting program-level cost-of-care and breakeven models to prepare the executive team with insights and data for successful payer rate negotiations.

The VOAMNWI Outcomes

VOAMNWI gained efficiency through streamlining operations, shortening financial reporting cycles (including the month-end close process), and reducing bad debt write-offs by 68% through the combined effects of these innovations and upgrades.

The cumulative effect of all VOAMNWI’s new technologies enabled real-time data sharing, and the more rigorous building of metrics to generate strategic business intelligence reduced the chart of accounts from 20,000 to 2,000 entries, enabling a culture of continuous improvement. The improvements in data infrastructure now support cost analysis and outcomes measurement, positioning the organization for successful payer negotiations for future value-based contracts that reward its commitments to quality and efficiency.

Leadership Advice

Ms. Steinke’s main advice is that improvements in quality, efficiency, and the financials can be gained when organizations are prepared to invest in technology, analytics, and the people with the skills to use the data. She broke that advice into four specific categories.

1. Start With People, Not Just Processes: Provider organizations can get the most out of technology only if they have the people who can put it to best use. This means intentionally recruiting staff for analytical roles early in its transformation enabled strategic forecasting that would otherwise have been impossible.

“We were very intentional about our recruiting efforts,” said Ms. Steinke. “We partnered closely with HR. We were looking for candidates who were self-starters, who were able to navigate through ambiguity, and who were really driven to support our mission.”

2. Invest In Strategy First & Technology Second: The “best” technology will always be the one that fulfills a very specific strategic need. Knowing—and agreeing on—the right strategy means bringing together leaders from all stakeholder teams to define what is needed before a vendor search even begins. Once the core metrics needed to manage sustainability are developed, the right technology selected will include the tools that are capable of supporting them. To support a culture of continuous improvement, you need to have the data and the tools to track where you’ve been, where you are, and where you’re going as an organization.

“We developed a cloud-based ERP software selection plan to establish timelines, assignments, and budgets,” said Ms. Steinke. “The weighted scorecard was a great tool. Before we reached out to anybody for their solutions, we identified what our top priorities were. Then we added a metric to it. We used this weighted scorecard to reach out to multiple vendors, and we scored them on what their capabilities were.”

3. Prioritize Real-Time Data Access: Dashboards that tie services to outcomes and revenue aren’t optional for technology solutions that support health care provider organizations. Technology solutions must either provide them or integrate with them to support the organization’s strategic needs. Decision-critical information delivered in real time isn’t optional. Data visualization capabilities are also a requirement.

Deciding which tools it needed and developing the right solutions took time and effort. VOAMNWI assessed its tools and improved them until it achieved the dashboard, metrics, and key performance indicators it needed. “Now we have real-time data in our dashboards that we can share with our board of directors, our senior leadership team, and our program leaders,” said Ms. Steinke.

4. Put The Data To Use For Financial Resilience: Executives must use their data to build scenario plans, model break-even reports, and understand the cost of care per unit so that they can plan for the future and invest for growth where the organization can be successful. Unit costing is an essential step in financial modeling to build and operate leaner, smarter, and more agile organizations that can adjust strategy and operations in the face of funding changes and expand in directions where success is most likely. “Developing program cost of care and financial breakeven models was very beneficial in going back to our commercial payers and renegotiating our rates,” said Ms. Steinke. “Understanding the full cost of care and what our fixed costs were was crucial to developing robust models.”

For CFOs and their leadership teams to build resilient finance functions, align operations with strategic goals, and embrace new models of care, they need the tools that will deliver data-informed insights so they can gain foresight. Focusing on what drives operations and how to use resources to be most effective and reduce the total cost of care are some of the most effective pieces of analysis that finance teams can provide.